The Risk Management Calculator – The ABC of Binary Options?

Binary Options Free Trading Tool 5 – The Risk Management Calculator

Trading is not all about making profit, but also conservation of capital, and it is for this reason that the concept of risk management is a very important concept in binary options, hence the introduction of the risk management calculator.

The risk management calculator is a tool that can be used to determine a trader’s risk exposure in the market before he gets into the trade. Many of these calculators exist as web-based tools and are available from the websites of financial brokers.

How to Use the Risk Management Tool for Binary Options Trades

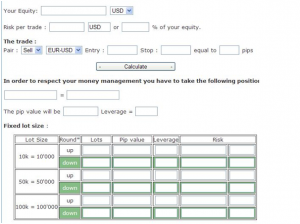

So the risk management tool is a web-based tool, and traders will need access to websites that offer this tool. In order to use it, the trader should have access to a website featuring a risk management calculator such as the one in this link or this one. The trader can input the information he needs to calculate his risk profile in the appropriate boxes. A very important parameter shown is the equity, because a trader’s equity actually determines how much risk he can assume. Parameters like the lot size may not apply in the binary options market because these risk calculators were initially developed for the more advanced Forex market.

Risk Calculator (courtesy of goforex.com)

Why the Risk Management Calculator Does Not Suck

The advantage of using this tool is that it goes further than the rudimentary tool on the binary options platforms which show the trader how much the trade will cost. The risk management tool usually looks at the total picture, and by applying the maximum allowable risk management percentage of 5% that is recommended for use by traders in financial trading, it is possible for the trader to know exactly how much he should be investing into the market considering his account size. The trader will therefore be in a better position to see if the cost of a trade he intends to enter will leave him overexposed to the market or not.

Why the Risk Management Calculator Sucks as a Binary Options Tool

It is strictly an informational tool. While it may show the trader how much risk he is assuming in the trade, there are certain trades that a trader may be forced to take in the binary options market if he does not have enough capital. For instance, if all a trader has to trade in binary options is $100, it is not possible to use the risk calculation from this tool because it would not conform to the minimum trade size in a binary options account. For this reason, the use of this tool is limited. Also, this type of calculator requires you to enter the amount of pips you will use for your Stop Loss order and will not calculate risk without this parameter, hence making it almost impossible to use for Binary Options trading.

A risk-free conclusion

Many of us turned towards binary options because trading them is a lot simpler than Forex and can be learned rather fast. Also, knowing the risk at stake doesn’t require complicated calculators and a basic understanding of math will suffice. All binary options platforms display the amount at risk – in fact, if you buy a $50 Call, how much are you risking? Do we need a calculator to tell us we are risking 50 bucks (assuming the broker doesn’t offer a refund percentage)? If you want to know what percentage 50 bucks represent relative to your entire account, all you have to do multiply 50 by 100 and divide the result to your account balance. Knowing your risk extremely easy and fast is one of the main advantages of Binary Options so we don’t really need complicated calculators.

Discuss the Risk Management Calculator on our forums.