The Lindencourt MX Method 15 TF Trading System

The Lindencourt MX Method 15 TF strategy is a Forex strategy I found over at Forexstrategiesresources.com. It uses the fifteen minute time frame and is supposed to work on all currency pairs. It uses two different indicators and the rules can be slightly hard to understand but I have tried to simplify them as much as possible. At least you only need to focus on a one-time frame, and the indicators are well known and trusted by the crew here at ThatSucks.com.

How does the Lindencourt MX Method 15 TF Strategy Work?

This strategy uses two indicators, the Commodity Channel Index and a pair of moving averages. To start, first, go to the 15 minute charts and add two moving averages, SMA 7 and 21 which can be found under Insert, Indicators and Trend in MetaTrader 4. Next, go to Insert and Oscillators and add a CCI period 5. CCI is Commodity Channel Index with the standard levels -100 up to 100 so make sure you add a level 0 because we are gonna need to keep an eye on the crossovers there.

The first rule is very simple, just look for the “good old” SMA crossover! If the MA 7 crosses the MA 21 then that’s your first sign and you should look at the CCI next. The author mentions that it’s important to wait for the entire 15 minutes of the current candle just to be sure that it’s not a fake and the MA crossover is confirmed. Once confirmed, if the CCI crosses the zero level, then that’s a signal.

One thing to keep in mind is the +/- 1 candle rule for the CCI/MA crossover. We don’t want too much time in between the two required conditions (CCI and MA cross). The best case scenario is when the CCI crosses the zero line at the beginning or during the 15 minute period for which the candle where the MA crossover took place. For example, if a candlestick drops down followed by SMA 7 dropping below the SMA 21 at 10:00 o clock, we want the crossover of the CCI to have occurred either in the 9:45-10 period or 10-10:15 period – hence the +/- 1 candle rule. Anything else is not a valid condition and should be avoided.

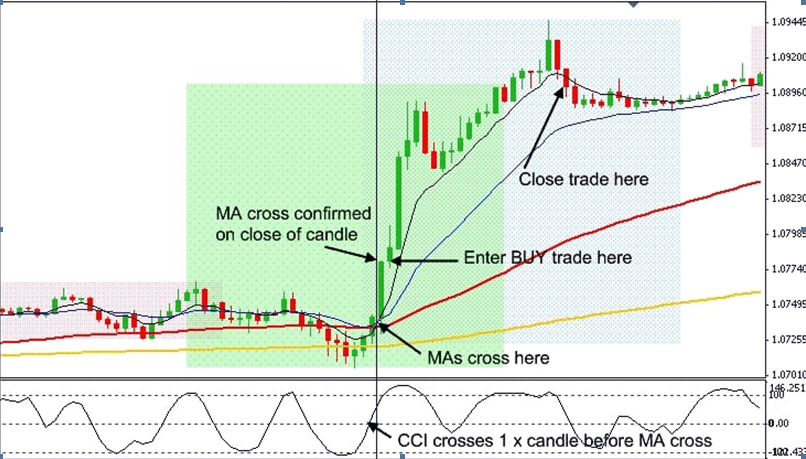

Example of call option. CCI crossed the zero level right before the MA cross (within 15 minutes of each other = valid rule). *Ignore the yellow and red MA.

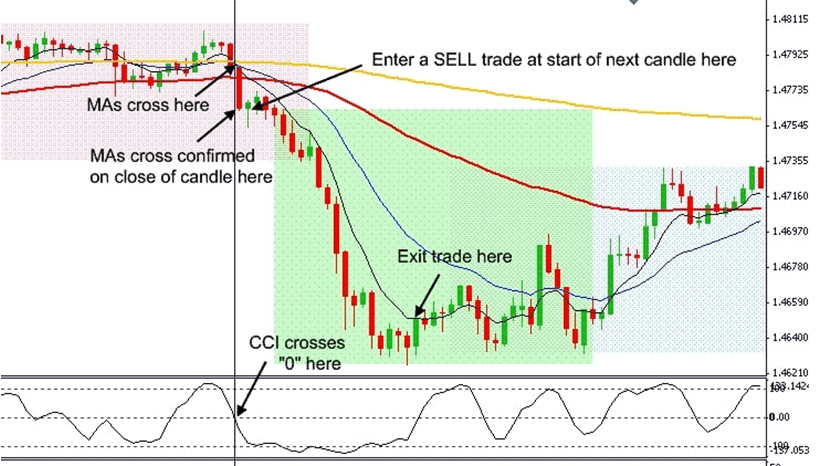

A Put option. This time the MA’s crossed each other right before the CCI crossed, within 15 minutes and hence confirming a put signal.

Strategy Rules:

Call Option: Wait for the SMA 7 to cross above the SMA 21 and confirm there is a M15 bullish candlestick going up too. Now watch the CCI and confirm that it has crossed above the level zero line either in the previous 15 minutes or in the next 15 minutes. If so, then enter a call option with 30 minutes to 2-hour expiry.

Put Option: Wait for the SMA 7 to cross below the SMA 21 and confirm there is a M15 bearish candlestick going down too. Now watch the CCI and confirm that it has crossed below the level zero line either in the previous 15 minutes or in the next 15 minutes. If so, then enter a put option with 30 minutes to 2 hour expiry.

Since this is a Forex strategy, there are no rules for expiry selection but as always, you should watch previous (most recent) history and calculate how many candles are needed. If you are not sure about this technique, you can learn how to choose the right binary options expiry from this article. However, since you are using the M15 chart, I believe we should focus on 30-60 minute expiries.

Why does the Lindencourt MX Method 15 TF strategy Suck?

The part that may suck for most beginners is the expiry selection part but that’s pretty much the case with all strategies as there is no such thing as the “ultimate expiry” and you must consider each condition separately.

Why doesn’t the Lindencourt MX Method 15 TF strategy Suck?

It doesn’t suck because it gives the traders two solid confirmations using MA and CCI but also a time interval during which the signals are considered valid. This rules out many fake signals.

Learn the Rules and Trade

If you have some experience with moving averages and oscillators then the rules should be pretty easy to grasp after a few demo trials. But remember that it’s equally important to also look at the charts! Don’t try to jump in on every crossover you find. Make sure the candlesticks are actually in trending conditions or are actually breaking out! Have patience and wait for all the conditions to be met.