Cantor Exchange and Partners Prepare to Sweep US Binary Options Market

The Rumors Swirl; Cantor Exchange Working With CySEC Providers

It’s been confirmed that not one but several new CFTC approved binary options brokers are on the verge of being launched in the US.

There are growing signs that several new brokers are about to launched on the US market. Not one but at minimum three of the top CySEC approved platform providers are currently working with Cantor Exchange to provide access and liquidity to the US market. Cantor Exchange (CX) is a subsidiary of Cantor Fitzgerald, a global provider of marketplace solutions. Cantor Exchange is a binary options exchange, not a broker, and is supported by Cantor Clearing House for financial processing.

According to company execs CX primary responsibility is to match buyers and sellers together while ensuring regulatory oversight and a fair trading environment. They operate on what they call a “pure exchange business model” which means they have no exclusive market makers and allow direct access to pricing for all participants. The new platforms and brokers built on them will be providing access to the exchange for those participants. Rod Drown, Senior Managing Director of Global Products and Services at CX says this means that when you trade on one of these new platforms you are trading with other traders on the exchange and not with the brokers as you are doing with CySEC regulated brands.

Top EU Technology Providers Partner With Cantor Exchange

Tradologic, Techfinancials and SpotOption are included in the list with others waiting in the wings. Tradologic is the most recent to get on board but certainly not the last. The goal for these providers is to create a white label platform that they can then sell for rebranding. Each new broker will be independent yet provide access to the same pricing on the exchange, expanding price discovery and ensuring the best prices possible for all traders. Tradelogic has at least two new brands that have yet to be revealed and the others are not far behind.

Connecting traders together on the exchange is no easy feat. It took Techfinancials 6 months to reach full integration and pass its certification period after the technology was first developed. SpotOption has been trading and writing options since winter 2015 and acting as a market maker on the exchange, all in preparation for a full launch sometime in the near future. TechFinancials is leading the charge into the US market and has already announced one brand gunning for CFTC regulation, OptionFair.

Speaking of regulation this does not mean that all brokers with access to the exchange will be US approved. The technology providers have built CFTC and SEC compliant trading platforms but it will be up to the individual brokers to register with the proper authorities in order to solicit US clients.

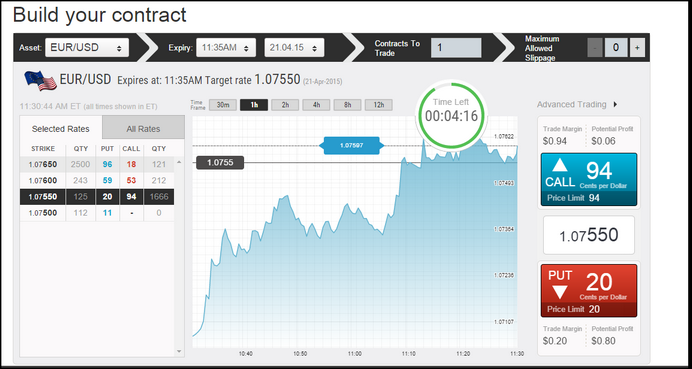

Screenshot of SpotOption & Cantor Exchange Trading Platform

What Happened To NADEX?

While these move are not surprising in and of themselves it is surprising that Cantor Exchange is the one with whom these deals are being made. The first glimmers of connectivity began in 2013 when then CEO of CTOptions Tzacky Pickholz told ForexMagnates that the brand was in talks with NADEX. NADEX, the North American Derivatives Exchange, is the first and currently leading US regulated binary options brand but one quickly to be eclipsed if Cantor succeeds in its plans. At the time of the interview it was thought that any foray into the US market would be through NADEX but they failed in delivery of a easy to use and attractive trading environment.

When these new developments begin to bear fruit it will mean a complete change in the US and global binary options industry. Not only will there be better access and liquidity for US traders, there may in fact become a global standard in which traders from around the world are able to buy and sell against each other.