Bollinger Bands©: The volatility tool for Binary Options

Binary Options Free Trading Tools –Bollinger Bands© by John Bollinger

Bollinger… John Bollinger. This smart guy needed some way of measuring volatility in the financial markets. Yes, volatility, a very important thing, as we all know because identifying times of high volatility or low volatility can help us a lot in determining the right strategy we need to use. In the early 1980’s John Bollinger found the answer to his quest; and it came in the form of two bands and a Simple Moving Average (usually a 20 period MA) which he simply called Bollinger Bands. Nice going! Why call them “Extreme Magic Indicator” or “100% Super Smooth and Accurate Trend Finder”? Nope, just use your name for it. If Batman would invent something, he would just call it Bat-something… and we know Batman is cool, no argument here. Now, let’s see how it works: the bands come closer together when the market is quiet and they move apart when the market screams, heading furiously in one direction or the other. But there is one more important clue we get from them: Bollinger Bands actually tell us when the market is going to explode by coming very close together, more than usual (don’t worry, I’ll attach a picture to see what I’m talking about). It’s like yelling at us:”Put on a Straddle strategy, because we are going for a wild ride”.

Why does Bollinger Bands© suck?

It is hard to think why they suck, because they actually don’t suck…well, even the best tools suck sometimes and I consider that the sucking part comes from the fact that Bollinger bands don’t really predict direction, they just identify the level of volatility. If we are caught on the bad side of volatility, it’s better to get out early and make use of our broker’s “Close now” option. Another area where they are not so strong is the profit target: they don’t really tell us where price is going to stop or reverse. Other than this, I can’t think of any more reasons why Bollinger Bands suck.

Why Bollinger Bands© doesn’t suck?

Where to start? They are easy to use, I think anybody can understand that volatility is increasing if the two bands are moving apart and volatility is decreasing if they come together. They predict big moves with very high accuracy. One more important thing is they can be used in combination with other tools to give us a sense of direction. For example, if the Relative Strength Index(RSI) is showing extreme overbought conditions and the Bollinger Bands squeeze very close together, more than usual, the probability for a short trade to bring profit is higher. Last, but not least, this tool is free and available on almost all charting software. There you have it: useful, free and easy to use tool.

How to use Bollinger Bands©

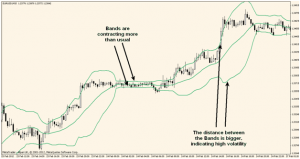

To install Bollinger Bands on a MT4 chart, go to “Navigator” – “Indicators” – Double click on “Bollinger Bands: and you are ready to go. I use the default value of 20 periods for calculation, but feel free to play with the setting to suit your style. Earlier I promised you a picture and here it is:

Notice that whenever price is moving strongly in one direction, the distance between the bands gets bigger and when the market is quiet, the bands are squeezing together. However, the contraction that we see on this chart is a clear indication that a big move is imminent. This is no time for a tunnel trade or for short straddles. Instead, use a Long Straddle as we know with a high probability that price is going to burst in one direction.

Bollinger Bands are a great visual aid for detecting high and low volatility times and deciding what kind of strategy will bring home the money.

Further Reading:

Visit Bollinger Bands(C) HomePage

- Bollinger Bands Forum Discussion on CommuniTraders