Trading With The Geek 2015 Recap – How To Get 26% ROI!

Trading With The Geek, The Full 2015 Year Recap

Whether you trade with the Geek or not you can’t argue with his results. The man makes profits and did so in 2015, read on to see just how good he did.

Trade Small, Trade Often; The Power Of Money Management

This year the Geek Account came into its own. My rules, my styles, my management and my tips combined together with the result of another profitable year. Before I get into the details I want to take a minute to say this; money management works. You have to use it. The power of trading small and trading frequently, rules based of course, is proven in my stats. To put it into perspective, over the past 18 months I have taken the Geek account from $15,000 to well over $40,000. I stick to my rules, I trade only 3% of my account and at this time even less than that because I’ve maxed out CommuniTraders trade size.

It’s kind of funny. Looking back at the last year, and looking back at my review of 2014, I see big parallels. The top lesson learned last year was money management, if for a different reason, and that is this years lesson as well. Last year I learned how it can save you from losses, this year I learned to have confidence in its money making power. I wonder what the coming year will bring but likely another insight into how account management is a good thing.

The Geek’s Results For 2015

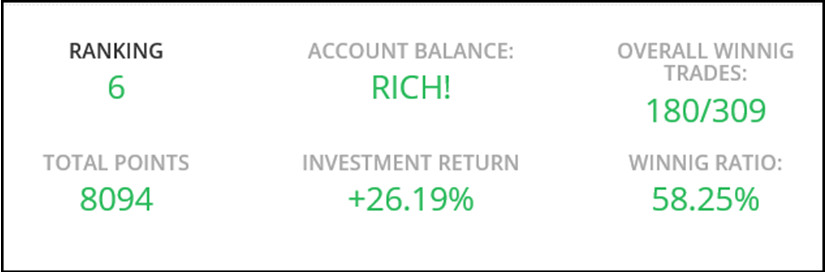

I had a pretty good year compared to 2014 in many ways. In 2014 total profits were just shy of $18,000 with an average monthly return of 23.93%. This year my average monthly return fell to 17.86% but my total ROI grew to over 26%, in part due to some great trades I made using my new Opening Momentum Strategy. Now, down to the nitty gritty. My total cost of trading was $138,800, about 8 times what my account was worth at the beginning of the year and a real sign of the power of risk management. My total return was $160,685 for a net profit of $21,885. Compared to last year profits grew by 17% while average return fell by 5 points.

The Geek’s Outlook For 2016

2015 was the year of the central bank. Central banks around the world were adjusting policy and stimulating economies and that is not likely to change much in 2016. All that change, and anticipation of change, led to a year of volatility and basically flat equities markets. Looking forward I see this all changing as the world begins to emerge from the growth slump it has been in, all led by the US. The FOMC is on a path of tightening that is a sign of growing economic strength. This strength, and anticipated strength, is going to lead to increased investment domestically and abroad.

Equities markets are likely to rise. My upside target on the S&P 500 is above 2,200 and that may be reached by early summer. The dollar is also likely to rise back to its high and higher as the FOMC increases interest rates and the ECB and BOJ remain dovish. This will in turn lead to lower prices for gold, the potential for parity with the euro and the USD/JPY and new highs. Oil prices may stabilize near $35 but are likely not going to see much of a rise over the next year, bad for oil companies but good for the global economy, which leads back into corporate spending, labor, consumer spending and my targets for the S&P.