Divergence D1 Strategy By James, the 007 of Trading?

Full Review of the Divergence D1 Strategy for Binary Options

This complex Divergence Trading strategy was originally created by James and posted on forex-strategies-revlealed.com. He claims it is a low risk divergence strategy since it focuses on the daily time frames but I say it is pretty complex. He says it is intended to trade currency pairs and we only need a couple of easy to use indicators but let me assure you, this is not for newbies. My recommendation, an echo of James own suggestion, is to fully understand divergence before you begin.

How does the Divergence Trading – D1 Strategy Work?

This strategy uses three time frames; daily, hourly and 15 minutes. It also uses 2 indicators as well as candle sticks. The first indicator we need is the Stochastic Oscillator with (5, 3, 3) settings and the levels 80, 50 and 20. For MT4 users, under visualization, select to only view it on the hourly and the daily time frame. Next, on the 15 minute time frame, set up three Smoothed Moving Averages with the following periods: 21, 14 and 7. The SMA’s will be used to pinpoint exact entries on the 15 minute chart. When your charts are set you will begin looking for divergence, starting with the daily chart.

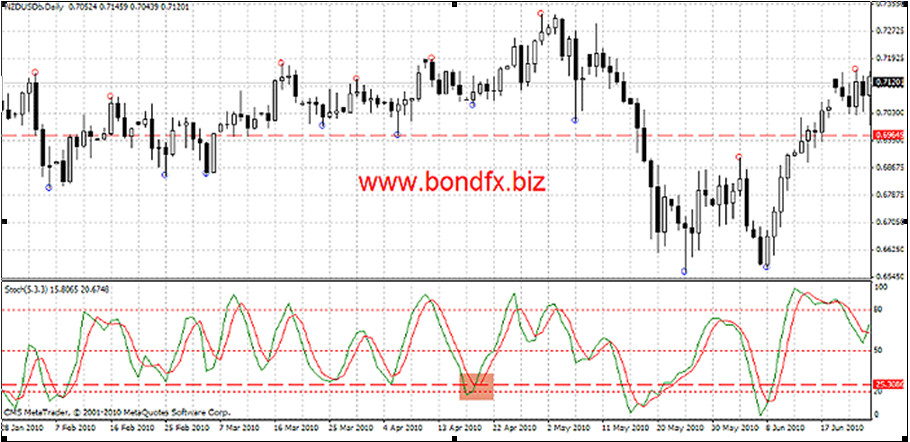

Notice the marked area on the Stochastic Oscillator! The bottom is lower than the previous oversold position, under the dashed line! Now look up and you’ll notice that the candlesticks are moving upwards, not breaking the dashed red line on the candlestick chart. A divergence is confirmed! Please view more examples on James blog.

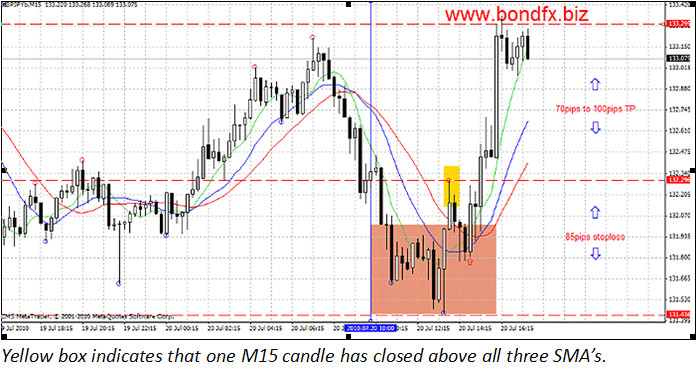

Start on the daily chart and find a divergence. In this scenario we look for a bullish signal. Make sure the daily candles low doesn’t break your horizontal support line but the Stochastic must break previous bottoms. This is a bullish divergence and you should now go to the H2 time frame and make sure Stochastic is below the 20 line here. If the H1 setup is confirmed you can proceed to the M15 and check if at least one candle is closed above all three SMA’s. That triggers the signal for a call option.

For a bearish divergence and a put option try to find an area where price is in a down trend but is retracing up, making Stochastic overbought. Either candles will break above your resistance line or Stochastic will break above previous overbought position. In either case it means a divergence is taking place and you need scroll to H2 and find an overbought position above level 80. Finally, go to M15 and make sure a bearish candle closes under all three SMA’s and take then a put option.

To make things easier when looking for divergence points James mentions that you can draw a horizontal line on your candlestick charts as well as the Stochastic Oscillator. It can help you to see divergences and price breaks. Just to further clarify what we are looking for, the author says that you either look for the price to break your candlestick chart line and not the Stochastic line or to break the Stochastic line but not the candlestick line.

Expiry is not brought up since this is a Forex strategy but I recommend at least 2 hours since we are relying in the H2 timeframe for entries. You can also try this on slightly lower time frames to get more frequent signals, replace the daily chart with H4 for example.

Entry Rules:

Call Option: Draw a support line and confirm a bullish divergence on your daily chart by locating a lower oversold level on the Stochastic or a support break. Then find an oversold level on H2, under the 20-line, and then go to the M15 chart and enter a trade when a bullish candle closes above all three SMA’s.

Put Option: Draw a resistance line and confirm a bullish divergence on your daily chart by locating a higher overbought level on the Stochastic or a resistance break. Find an overbought level on H2 above the 80-line and then go to the M15 chart to enter a trade when a bearish candle closes under all three SMA’s.

Why does the Divergence Trading – D1 Strategy Suck?

The major drawback is that it is quite the complicated strategy. It is only suitable for advanced traders who understand how to draw support and resistance lines, and how to identify divergence points on the charts. Signals are rarely generated on the daily charts and setting expiries is difficult.

Why doesn’t the Divergence Trading – D1 Strategy Suck?

Despite some negative comments on the original website I believe this strategy delivers… if you are experienced enough to understand the rules … and you can interpret charts. By replacing the daily chart with the H4 you will increase the signal rate but still have a pretty accurate strategy.

Conclusion – Divergence Advantage!

The Divergence D1 strategy takes full advantage of the Stochastic Oscillator in addition to relying on the accuracy of the higher time frames. Finding exact entries is not a problem either, the rules are relatively clear and the SMA’s show you exactly where it’s good to enter. I think it should work just fine for binary options traders but only if you have some experience under your belt, this is not for newbies. As I mentioned before there are several negative comments on forex-strategies-reveled but I think the pessimism is due to lack of understanding of this complex system. I recommend you try it on a demo first and see if you can find the divergence points and that you fully understand the entry points before you go live.

James has explained this in more detail on his blog, bondfx-trading-plans.blogspot.se. There are many pictures there explaining different divergence setups, I suggest you take a look at them before you continue.