The Newbie Friendly Guppy System, Fish Food Or Shark Bait?

Guppy Moving Average Strategy For Binary Options Trading

The Guppy System may have a funny name but the results aren’t funny. This is a fantastic system for new and old traders that provides a series of easy to read signals in line with prevailing trends. It was first described by Darryl Guppy, long time trader, in his book Trend Trading. His system is based on wave theory, uses a complex set of moving averages and takes multiple time frame analysis into account without the messy use of multiple charts.

What Is The Guppy System

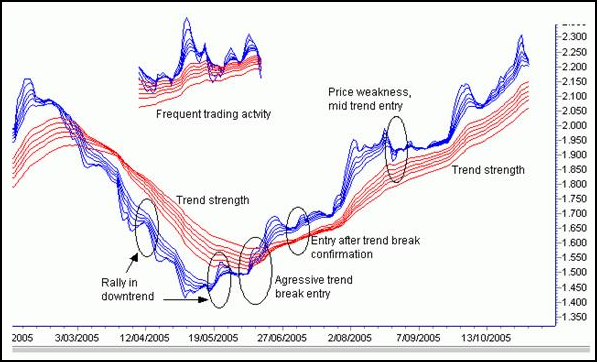

The Guppy System is not fish tank equipment if that is what you are thinking. It is a simple system based on moving averages that is both easy to use and effective. The most difficult thing about it is setting it up. It uses 13 exponential moving averages set up in 3 groups. The first two are groups of 6, 6 short term averages and 6 longer term averages, the third is a single average, the 200 bar. The averages are 3,5,8,10,12 and 15, the longer term averages are 30, 35, 40, 45, 50 and 60. The first group should be in light blue, the second group in dark blue and the 200 bar in red. The 200 bar can be substituted with the 150 for volatile assets and you can switch the whole array to simple moving averages if you want to weed out more of the false signals. The original system was designed for really short term trading using 5 minute charts.

The system is a trend following strategy, the 200 bar moving average being the trend setter. If it is moving up you look for bull signals, if it is moving down you look for bear signals. Signals occur once the short term and long term moving averages cross over the 200 bar average, in line with the trend. All moving average must have crossed for a signal to be valid. Once the first signal is fired additional signals occur whenever price retreat back past the short term array of moving averages and then recross in line with the trend. Strong signals occur when prices actually touch back to the longer term array. One way to find signals is to watch the spread between the averages. When they are wide you wait, when they are narrow you buy.

Why This Strategy Might Suck

This strategy might suck because you may have to wait a long time for a signal, even using the 5 minute charts. Signals rely on a full crossover of the short and long term moving averages so any reversals will take time to confirm and trading ranges could play havoc with your analysis.

Why This Strategy Doesn’t Suck

The strategy doesn’t suck. It may be time consuming, it may take a while for trends to establish themselves but the signals you will get will be very good ones. On top of that, once you catch a reversal you will be able to get a number of signals following it, until the next time prices reverse. The strategy is based on several well respected methods of analysis, incorporates multiple time frame analysis into one chart and can be used in multiple time frames.

My Last Thoughts On The Guppy System

The Guppy System may have a funny name but it doesn’t have funny results. What it has are results you can rely on, if you have the patience. Depending on the market and/or time frame you are trading it could take quite a while for tradable signals to develop. The good thing is that this system is great for any asset and can be used in any time frame so you can adjust as needed until a trade comes into focus. I can definitely recommend this for newbies and pros because it gives easy to read signals that are perfect for binary trading.