December Trading with the Geek Tips Results – Ends A Good Year Of Trading

December Ends A Good Year Of Trading

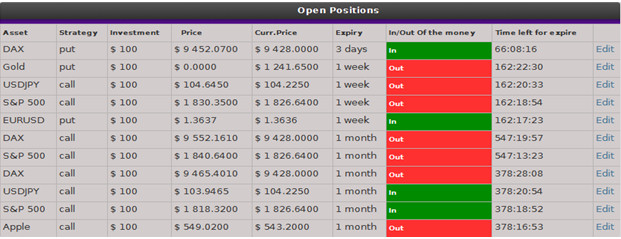

In December I was able to continue my streak gains. During the month 21 trades including some long term trades placed in November were closed. Out of those 21 only 7 were losers for a win rate of over 66%. This is the fourth month of net gains for the Geek account. During the month I made a total of 25 tips (five Monday’s) with no extra trading due to the holiday’s. I decided to take some time off to reflect on what I have been doing, adjust my strategies for the next year and to just enjoy myself and my family over Christmas. Most of my trades this month were for weekly expiry but there are a handful of trades with one month expiry that are still open. Of those four are currently out of the money but I expect the long term trends to come back into play and bring these back to profitability.

Here is the financial breakdown for December. I made 21 trades, all for my standard $100 making the total cost of trading $2,100. Of those 21 trades 7 were losers, 14 were winners for a gross return of $2590 and a net profit of $490. This is 23.3% return of investment for the month. I have been able to maintain my number 2 position on CT for number of winning trades but my net gain on account has remained flat. This is because at this time CT does not account for open trades. At the end of November there were 4 open trades ($400) and at the time of this writing and screen shot there are 11. Counting in just the trades placed in January (5 for $500) the net gain on my account was up about 1.5% month on month.

Total Cost Of Trading = -$2100

Total Return On Winners = $+2590

Net Profit/Loss = +$490( +23.3% return of investment)

December Tips In The Bag

There were five weeks in December for a total of 25 tips. Because of market volatility, the holiday’s, the taper question, the end of the year and other reasons many of my tips were for longer than one week which left 6 open at the end of the month; one trade on Apple, two trades on the SPX, one on the USD/JPY and two on the DAX. These trades are expected to come back into the money before expiration. Of course!

The Indices

Stock indices are my forte, so to speak, and the DAX is my choice in the EU arena. I only traded this one four times in the month but did a slightly better job than I did with the S&P 500. Of the four trades two closed in the money and two are still open. The S&P 500 is my most closely watched asset and most traded asset. I make a tip on this one every week regardless of where it is or what it is doing and so far it is also my best performing trade. This month not so much however. The taper fear is what really got me and is the reason I switched out my short term one week trades for longer term monthly ones (giving my trades a chance to move past the FOMC meeting and into the money). Two of these trades are still open, one currently in the money. Of the three closed trades only one was profitable, not very good in my opinion.

Currencies (Forex)

To be honest, I got my start in stocks and have only begun to trade currency/Forex with binary options. Also to be honest, now that I have gotten my feet wet with Forex I will never not be a Forex trader. I choose to use the EUR/USD and USD/JPY because I live in a dollar based economy and these are among the most heavily traded pairs. I tend to make a trade on each one each week but that is not always the case. This month I traded these pairs 5 times each with a pretty good win ratio, only 4 have closed out of the money and only one is still open. The taper had a big impact on these trades and will continue to do so into the near to short term.

Stocks

I tend not to trade individual stocks as indices are more my style. From time to time a story, announcement or technical set up presents itself that I must act on. This month I saw 3 of these opportunities, two on Apple and one on Facebook. So far two have closed in the money and only one, Apple, is still open but also currently in the money.

Commodities

The only commodity I regularly trade is gold. Gold is the number one traded asset worldwide and thereby the most liquid and most predictable market there is, at least in theory. I have been bearish on gold for months, maybe years it seems, and have been doing well with that approach. This month was no exception. I made a total of 5 tips on Gold with 2 closing in the money, one out of the money and two still open at this time. Gold may be nearing the bottom but it is not in place yet. The taper, central bank meetings and economic data will provide us more evidence. The price of gold could keep moving lower if the global economy is still more or less on track.